The goods and/or services produced, in-house, can be capitalized into asset(s). But, there are two distinct phases during this process:

- Construction phase (AuC)

- Utilization phase (useful or economic life phase)

It then becomes necessary to show the assets under these two phases in two different balance sheet items:

The ‘construction phase’ is one in which you start producing or assembling the asset but it is not yet ready for economic utilization. SAP categorizes these kinds of assets into a special asset class called ‘Assets under Construction’ (AuC).

The AuC is managed through a separate asset class with a separate asset GL account. SAP allows posting ‘down payments’ to AuC. It is also possible to enter credit memos for AuC even after its complete capitalization, provided you are managing this asset class and allowing negative APC (Acquisition and Production Costs). The IM (Investment Management) module helps to manage internal orders/projects for AuC. It is necessary to use the depreciation key ‘0000’ to ensure that you are not calculating any depreciation for AuC. But you can continue to have special tax depreciation and investment support even on these assets.

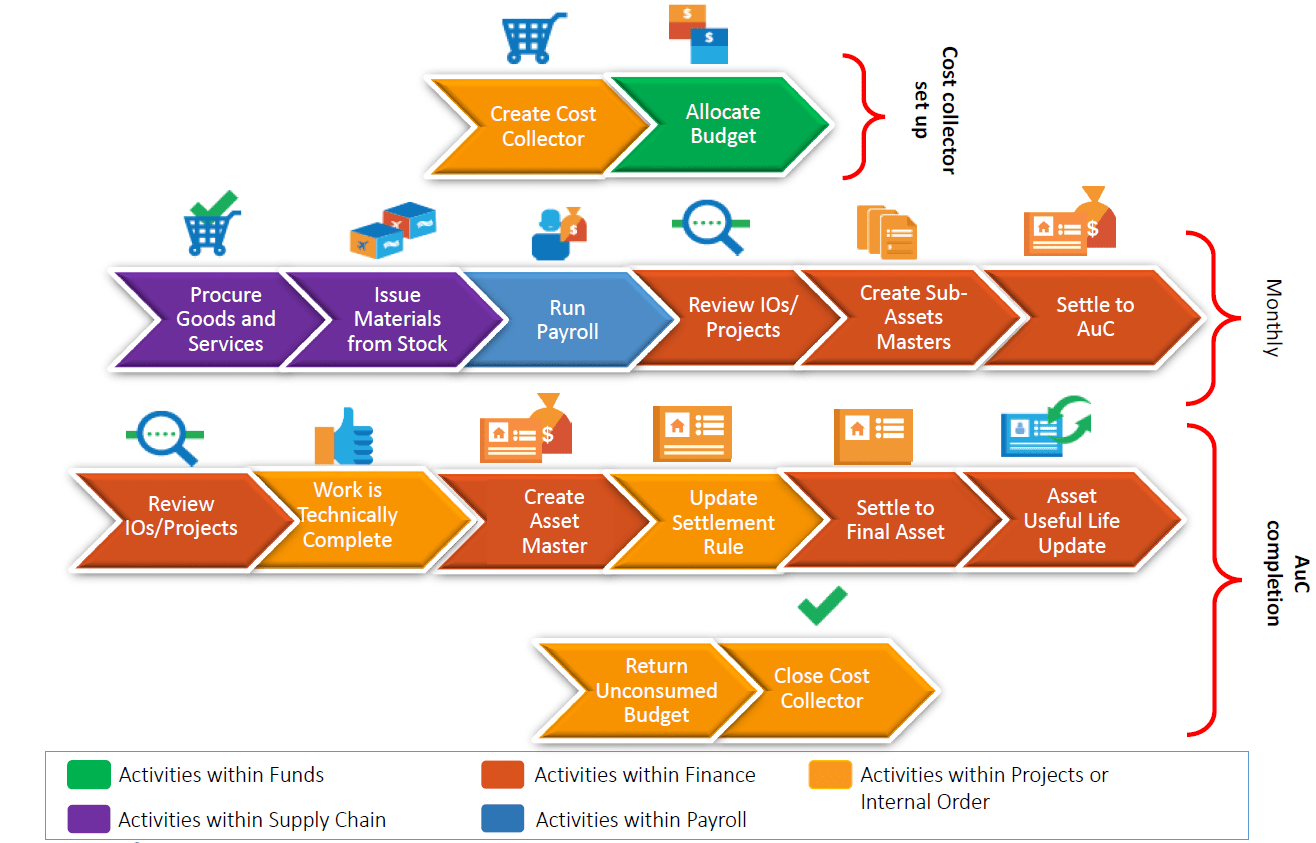

Process Phases of Asset Under Construction in SAP

An Asset under construction (AuC) goes through three main phases throughout its life cycle.

- A cost collector is set up and funding for the AuC is budgeted and released.

- Monthly Activities: Until the asset is completed, costs are settled monthly to the AuC and/or cost center.

- Once the AuC is completed, there is a final settlement to the final asset and the cost collector is closed.

How to return the unconsumed budget and close the cost collector